Last Saturday night Greg and I piled the kids into the Suburban and headed off to Danbury Duckpin Lanes for a night of fun.

Last Saturday night Greg and I piled the kids into the Suburban and headed off to Danbury Duckpin Lanes for a night of fun.

There are all kinds of things that I love about going there – it’s been family-owned and operated for over 40 years; it’s filled with 50s music and memorabilia; and it feels like you’ve stepped back in time (more on that in a minute).

And, most of all, it includes bowling!

I know, people who love bowling are odd, but what can I say, I’m one of them. Duckpin bowling is even odder. Unlike “regular” bowling, with Duckpin you get three balls instead of two to knock down the ten pins. Plus, the balls fit into the palm of your hand and the pins are short and squat (duckpins).

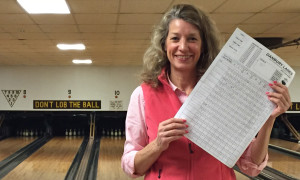

Danbury Duckpin Lanes is not automated one bit. You need to push a button to start the machine that sweeps away the leftover pins. You need to manually place the bumpers, if you use them. And … you need to keep score by hand.

If you’re under 40, there’s a very good chance that you have no idea how to score bowling manually (the kids sure didn’t). Greg and I sort of remembered (although I confess we had to ask our neighbors in the next lane over a few times for help).

All of which got me thinking about how some solo and small business owners run into trouble when running their businesses: They have no idea what goes on behind the scenes.

But that’s a problem. Because no matter how smart (or busy) you are, if you don’t control the essential pieces of your business, you’re liable to find yourself in trouble one day. With that in mind, here are three things you must keep control of:

1. Documentation. You don’t need to personally manage the processes of your business, for example, but you want to make sure that whatever happens on a regular basis is written down. Without that, if Susie the webmaster wins the lottery tomorrow, you’ll have a tough time picking up the pieces and replacing her.

Same goes for knowing where your web site is hosted, where your domains are registered, what cell phone service(s) you use, etc. Ask your people to document their workflow and key technologies.

2. Passwords. Can you log into your web site? Do you have the administrator password for QuickBooks? Do you have the building alarm codes?

You don’t need to know what to do when you log into these various accounts (for example, you don’t need to know how to be a bookkeeper once you’re in QuickBooks), but you need access through the front door, so that you can bring in another expert as needed.

3. People. As a small business owner, there may be several freelancers/consultants out there in the world who keep the wheels turning. Not employees, but important people: IT support, designer, copywriter, bookkeeper, attorney, etc. Here too, you don’t need to be involved in all of these relationships but you do need to know who they are with and what they are for.

I understand that part of growing a business is delegation – you can’t touch everything if you hope to grow the business beyond yourself.

Still, it’s worth your time to think about – and organize – the pieces so that when Susie’s number comes up, you’re not left scrambling!